COVID-19 Accelerates Digital Momentum

As retailers step up rollouts of frictionless payment, delivery and order-ahead services, the call for integration intensifies.

CStore Decisions | Erin Del Conte | June 5, 2020

As the COVID-19 pandemic rolled across the U.S., convenience stores with frictionless checkout or order-ahead options found themselves ahead of the curve in adapting to social distancing requirements while still providing timely service to customers.

When the pandemic hit, Baltimore, Md.-based High’s was already offering Skip frictionless checkout at the majority of its locations, as well as its proprietary Carroll Pay program at all stores. To pay with Carroll Pay, customers can use a card — similar to other private-label debit card programs with perks — or the High’s mobile app.

“When the customer utilizes the High’s app, it greatly reduces the amount of ‘contact’ the customer has with high-traffic surfaces,” explained Noah Sanders, senior implementation and analytics manager for High’s, which operates 49 c-stores.

For example, customers who want to avoid touching surfaces during the pandemic can use the High’s app to activate the pump without touching the customer PIN pad. Inside the store, customers can enter their PIN on their smartphone, and the phone can be scanned with a barcode scanner, eliminating the need to insert or swipe a card at the PIN pad. Both at the pump and in-store, customers can opt to receive their receipt in the app or via email.

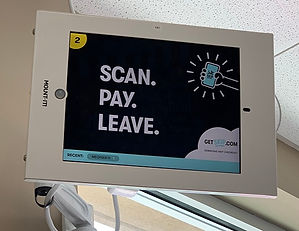

Or, they can scan and pay for everything themselves using the Skip app. Due to the pandemic, High’s has also rolled out “an ‘old school’ order ahead with curbside pickup” option at a few locations, but the chain has also been working with Skip to create an order-ahead platform that is set to launch soon.

DIGITAL ACCELERATION

The pandemic has accelerated and reprioritized how people consider the digital experience, said Ed Collupy, executive consultant at W. Capra Consulting Group. “What the pandemic has shown me is this need to get to market faster with things,” he said. “I think we’re seeing a number of changes and implementations that have come along very quickly.”

He pointed to Altoona, Pa.-based Sheetz’s new “SHcan & Go” feature in the Sheetz app that allows customers to scan and pay for purchases, as well as several convenience retailers that have added delivery using third-party services.

Having the frictionless checkout technology via Skip available in the middle of a pandemic proved a major asset for Chapel Hill, N.C.-based Cruizers c-stores, a division of Holmes Oil Co.

“It has been extremely helpful,” said Mike Wilson,

chief operating officer of Holmes Oil. Cruizers

created additional signage and ran a social media

campaign to help educate new users about the

frictionless technology and saw the user-rate grow

5% over its previous rate of growth.

Wilson had been hopeful the use of Skip would have

skyrocketed even higher during COVID-19, but he

pointed out that customer counts were down during

the pandemic, and its biggest Skip users are from

local universities that were closed or operating remotely.

“Losing that type of customer drastically affected us when it came to using Skip. Many essential workers and first responders tended to use cash for their purchases,” he said. Cruizers first launched Skip in January 2019, later expanding it to its entire chain of 27 c-stores in North Carolina by April 2019. Now, a little over a year later, the company continues to see an upward trend in the number of new transactions each month using Skip, even before the pandemic.

“As that trend continues to grow, the number of customers that come back and use Skip again is about 70%,” Wilson said.

Cruizers uses the Passport point-of-sale (POS) system with PDI back office. “Skip uses tablets to notify employees in the front of the house and communicates with our Pricebook through the back office,” Wilson said. Cruizers is currently developing a Cruizers App that will integrate Skip.

“The largest challenge that we have had is getting customers to download the Skip app,” Wilson said. “Once we get them past that hurdle, things go extremely smooth. We believe that having customers access Skip through our own app will drive the user count to much higher levels as it would be easier to drive promotions.”

As c-store retailers seek the flexibility to add and integrate new solutions from frictionless checkout and delivery to order ahead and curbside pickup, Collupy sees a push in the industry to use APIs — application programming interfaces that allow software to communicate — to make POS systems more open.

“The touch point is typically at a mobile device, but you want

integration to the POS so you don’t have disjointed systems,”

Collupy said. As c-stores roll out order ahead and pickup in store,

if those programs are not integrated into the POS system, retailers

have the burden of maintaining them separately.

“That’s not going to be the best for retailers,” Collupy said. “So

they’ll put pressure on the legacy POS vendors to say, ‘Hey, we

need integration.’ And then that brings you back to API and (the

question of) how we get these integrations done.”This shift could

open the door to startups looking to emerge with new solutions in

the market, he added.

While the pandemic has inspired more customers — and therefore

retailers — to seek out contactless payment options, c-stores tend

to have a higher-than-average percentage of cash sales on in-store

purchases compared to other channels, said Perry Kramer, managing

partner, Retail Consulting Partners.

“This makes it more challenging to achieve a ROI on improvements they make to the payment experience in a reasonable time,” he said.

As a result, retailers with order-ahead or loyalty programs in place have typically been the early adopters of mobile wallets and apps that support contactless payment. But the pandemic is inspiring more retailers to take the plunge.

“It is important for retailers to realize that, for most of these technologies, they need to start the journey 18 months or more before they expect to have them deployed in production and operating smoothly,” Kramer said. “To be realistic, if a retailer is starting from scratch in this area and expects to have some of these new payment technologies operating smoothly in the year 2021, they need to start the planning and budgeting now.”

EMV EXTENSION

Also due to the pandemic, Visa has delayed the EMV liability shift deadline for automatic fuel dispensers (AFD) to accept chip cards from Oct. 1, 2020, to April 17, 2021.

Collupy predicted Mastercard would make a similar adjustment. Indeed, by press time both Discover and Mastercard had followed suit. Both moved their EMV liability shift deadlines for AFD to April 16, 2021, a day before Visa’s deadline. “While we were already on track, the extension helps us, in regards to giving some of our dealers additional time,” said Cruizers’ Wilson.

For High’s, the extra time is less helpful. The chain is already “mostly compliant” with the new EMV requirements and was scheduled to finish ahead of the previous deadline, noted Sanders.

Despite the extension, the takeaway for retailers is to continue pushing ahead with EMV integration at the pump. “There are still the same demands that require planning and that require decisions to be made on time,” Collupy said. “If retailers haven’t been in the mode of planning and making decisions, they should be doing that now,” he said.

Retailers who have been moving forward can still execute what they can. For c-stores with POS vendors who are ready with software updates, Collupy advised creating a plan for testing and rollout. He urged retailers with POS vendors who are not ready to push the stakeholders — whether it’s the POS company or processor acquirer — for action. Nonaction has consequences for retailers.

“If you don’t do it, you’re going to get chargebacks, and those will mount up,” Collupy said. “The shift in liability waits until the new deadline, but other chargebacks continue.”

While EMV compliance at the pump brings a significant financial strain to c-stores, Kramer urged operators to see the move as a “once in a decade opportunity for change.”

“The introduction of this new technology should result in reduced security risk, reduced interchange fees and provide a hardware platform that should support contactless and all types of mobile wallets,” Kramer said. “It is important that retailers addressing EMV at the pump and other AFD changes do not short-change themselves by limiting these changes to the forecourt.”